Activism and BDS Beat 13 December 2012

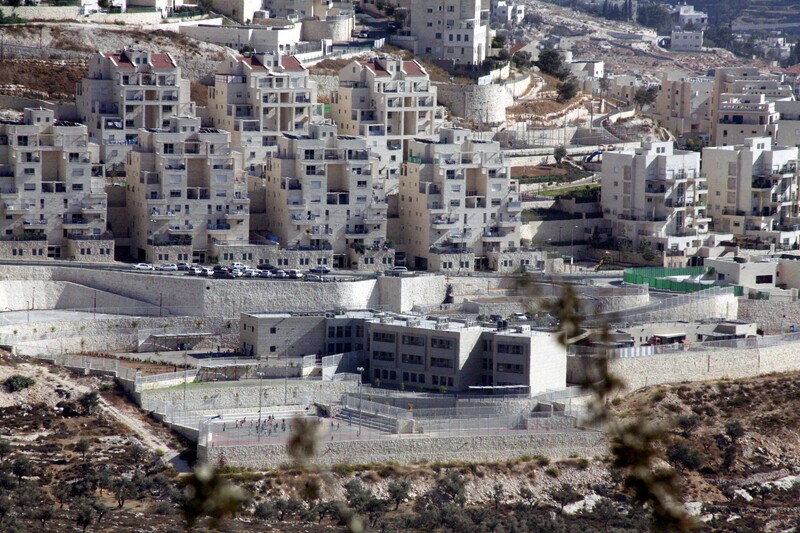

Israeli settlements on occupied Palestinian land, like this one near eastern occupied Jerusalem, are illegal under international law.

APA imagesNew Zealand’s $20 billion national pension fund has divested from three Israeli companies because of their direct involvement in building settlements and the annexation wall in the Israeli-occupied West Bank.

In a statement posted on its website on 12 December, the New Zealand Superannuation Fund announced that shares in Africa Israel and its subsidiary Danya Cebus and Shikun & Binui had all been sold “because of their involvement in the construction of Israeli settlements in the Occupied Palestinian Territories.”

Shikun & Binui is Israel’s largest real estate development firm.

Elbit Systems Limited was also divested from “because of its involvement in the construction of the Separation Barrier in the Occupied Palestinian Territories,” which, as the statement notes, “has been cited as illegal under international law.”

Illegality of Israel’s actions “central” to New Zealand decision

The total value of shares the fund had held in the three companies was relatively small – about $50,000 – however, it is significant that the illegality of Israeli practices in which the companies were involved was “central” to the decision to sell them, as the Fund’s statement said:

Findings by the United Nations that the Separation Barrier and settlement activities were illegal under international law were central to the Fund’s decision to exclude the companies, said Manager, Responsible Investment Anne-Maree O’Connor.

The Fund also factored in votes by New Zealand for UN Security Council resolutions demanding the cessation and dismantling of the Separation Barrier, and the cessation of Israeli settlement activities in the Occupied Palestinian Territories.

The Fund also viewed the companies’ activities to be inconsistent with the UN Global Compact, the key benchmark against which the Fund measures corporate behaviour.

The action by the New Zealand fund – the equivalent of the US Social Security Administration – follows earlier decisions by Norway’s state pension fund to divest from the same companies.

Last week, Elbit Systems, a major Israeli arms manufacturer, pulled out of an international aerospace convention in France following protests by Palestine solidarity activists.

Campaign to tell hunger charity City Harvest to disavow funding from Africa Israel owner

Africa Israel, owned by Lev Leviev, among other things a conflict diamond tycoon, has also long been the target of successful activist campaigns.

This week Adalah-NY launched a campaign to tell City Harvest, a charity that works to alleviate hunger in New York City, to disavow funding from Leviev. “Alleviating hunger in New York City by legitimizing a contributor to poverty and hunger in other countries contradicts the spirit of social justice,” Adalah-NY said in a message it urged people to send through its website to City Harvest Executive Director Jilly Stephens.